New feature in a B2C product

Qred Bank offers loans and cards in a quick and easy manner to MSMEs. Around 30,000 users across 7 EU countries enter the onboarding funnel every month.

My role in Acquisition

My role in the the Acquisition team is to acquire new users to apply for a loan or credit card and reduce drop-off across the onboarding funnel, thereby increasing the revenue of the company.

Problem Statement

Insignificant number of card applications compared to loan applications. 10k card applications all time compared to 30k loan applications per month. But unlike loans, the cards are present only in 3 of the 7 markets that Qred operates in.

Our Goal

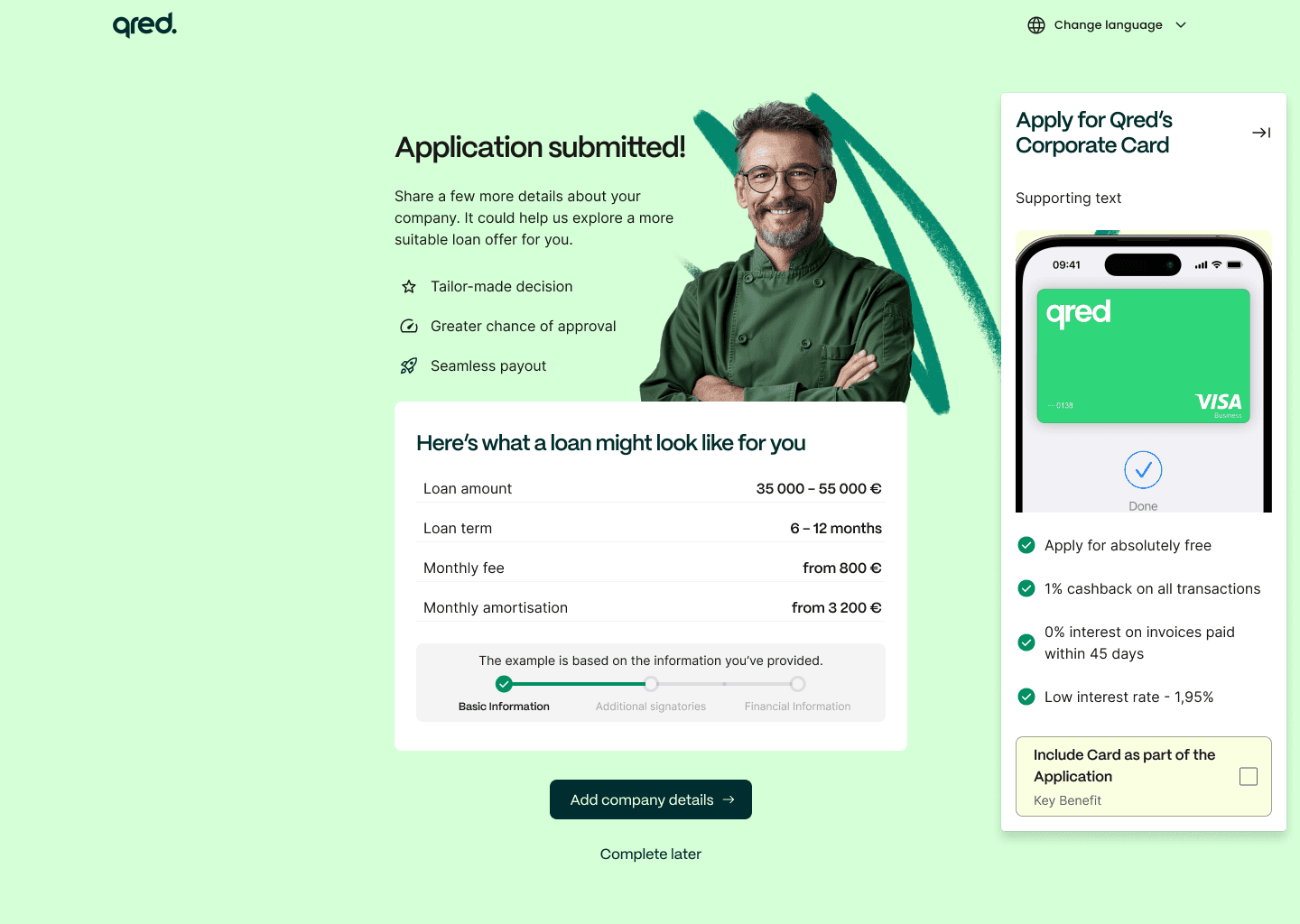

Increase revenue by scaling Qred’s credit card to applicants who are applying for a loan. The goal is to provide users seeking a business loan with the opportunity to apply for a card with the goal of at least a 10% opt-in for the cards.

Our Design Decision

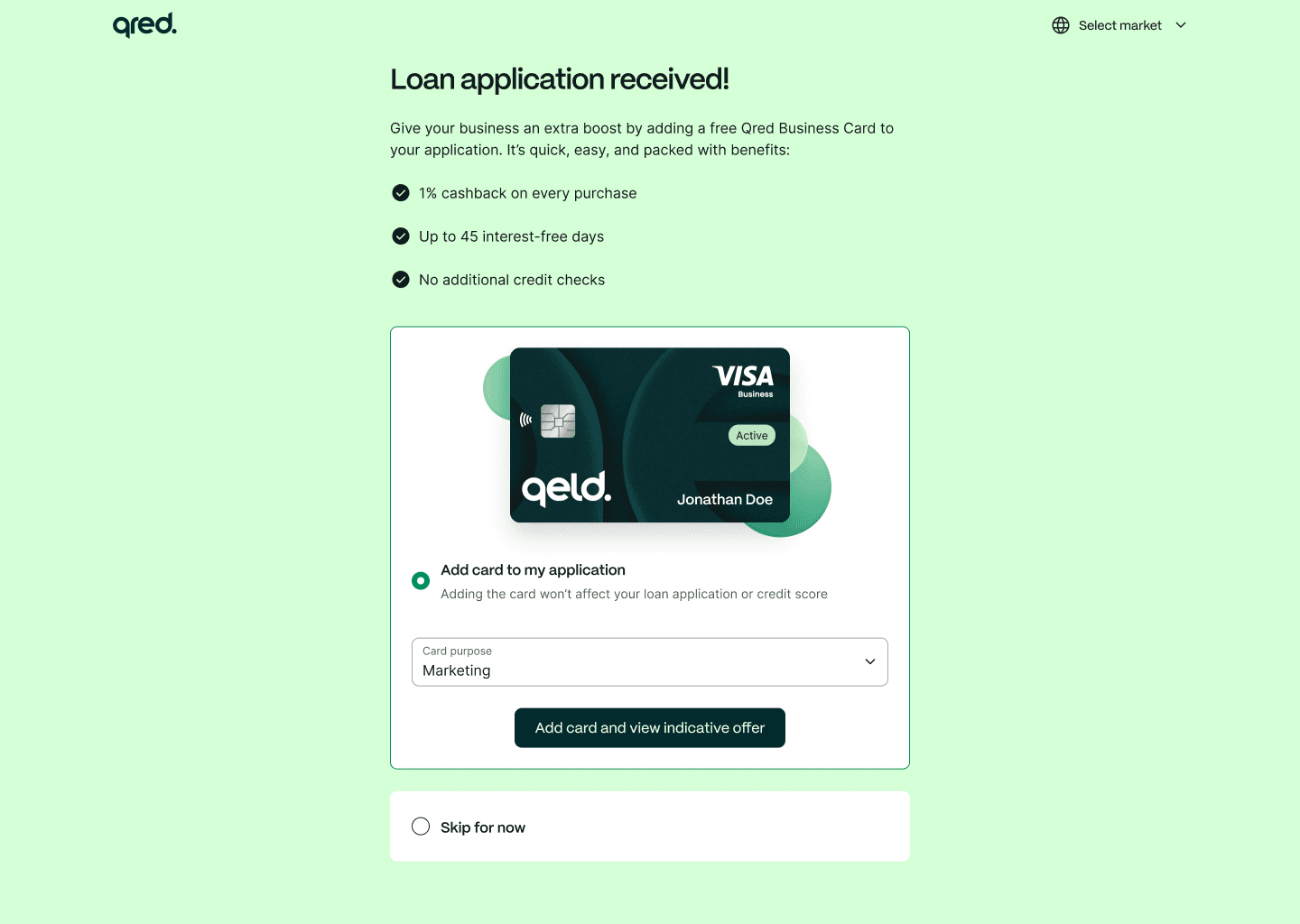

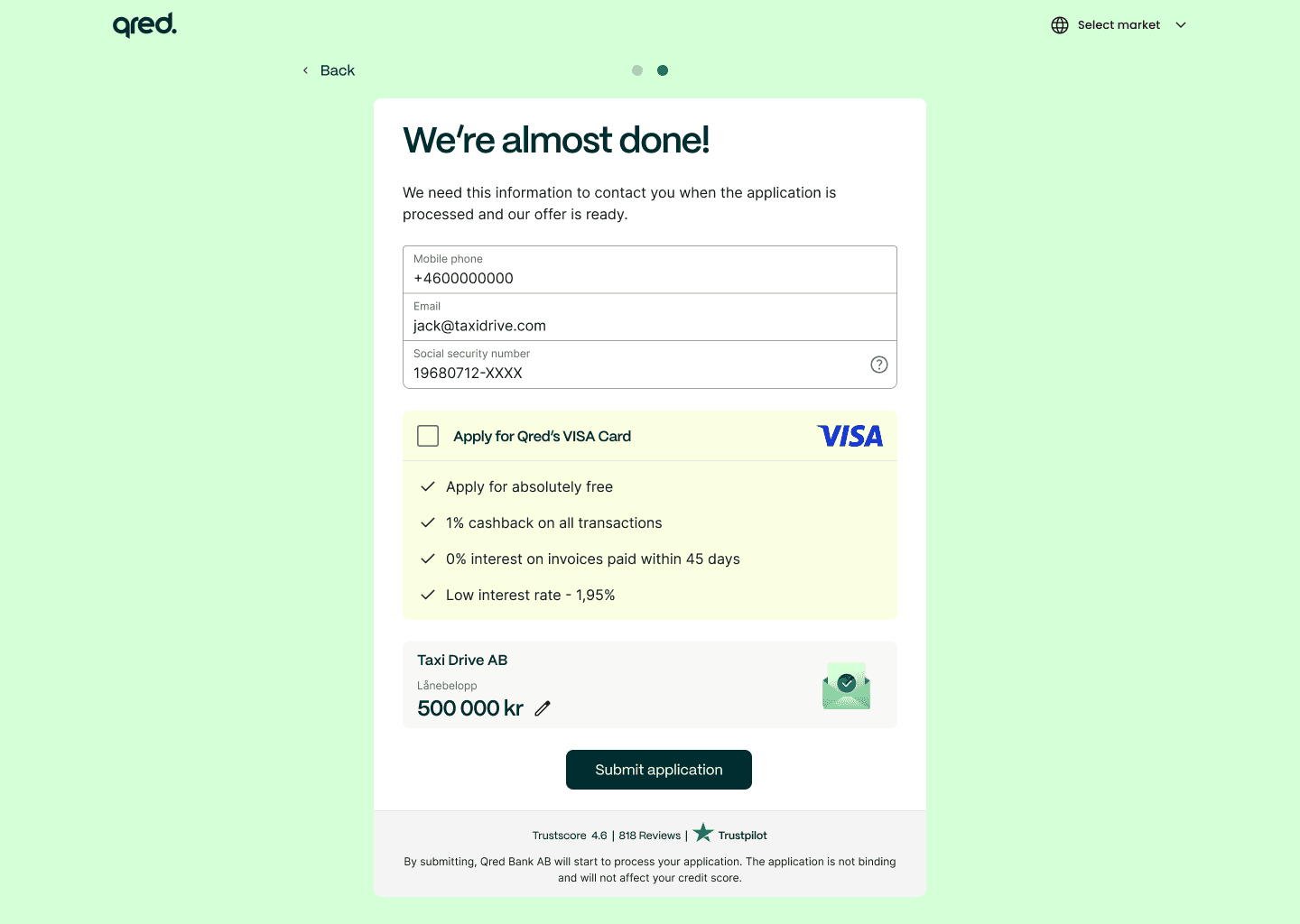

We chose Option A - introduce the card offer earlier in the flow, integrated alongside the loan journey, to establish value context before users reached later decision-heavy steps.

Technical Constraint

Displaying the name of the applicant on the credit card, which was aimed at creating a sense of personalization, was deemed as high backend effort which is why it was not implemented in this project.

Validation & Iteration

We achieved a 25% opt-in rate for the Qred Visa card, thereby surpassing our goal by 15%. However, our Guardrail metrics (which included the Loan completion rate and Application abandonment rate) were negatively impacted but fortunately not in a significant manner. The main reason behind the decrease is the introduction of another product in our loan onboarding.

Based on stakeholder reviews, we decided to change the microcopy of the step to focus more on the free aspect of the card.

Outcome

25% opt-in rate

13% higher than the target

Guardrail metrics ↓

Took measures to ensure that the decrease is not significant